For the next few minutes lets put the outrage that Wonga, the web based short term Loans Company, creates amongst consumer groups, Bishops and radio chat show hosts aside and instead concentrate on why it works. Because work it most certainly does. It is just about the fastest growing financial services company around at the moment.

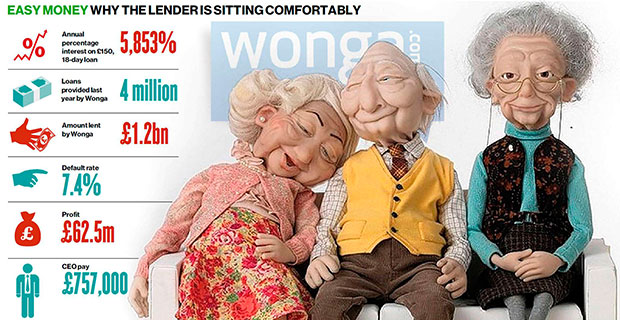

Wonga launched in the fall of 2007 into a market thought to be high risk and low yield, a combination that had scared off many venture capital investors. Today, after around four million small loans amounting to around a billion pounds of investment Wonga has thrived where many have fallen. How come?

There has been a lot of comment on smart algorithms and savvy launch timing but from the Honey perspective Wonga has won because it has also taken branding seriously. Not the sort of superficial badge slap that a lot of financial companies mistake for branding, nor the worthy and formulaic refurbishment of storefronts… sorry, I mean banks of course … and consumer friendly staff training, but real branding. Wonga is a well differentiated, consumer driven, well executed brand with some great attributes.

Wonga is transparent. You tell Wonga what you want and it tells you how much it is going to cost you. It is the definitive transparent transaction.

Wonga listens to you and gives you exactly what you want. There are no intermediaries trying to persuade you to borrow more/less, take more time/ less time. You can evaluate what you want to do and act on it just as if you were all grown up and knew how to tie shoelaces and everything.

Wonga makes it simple. If you can work an iPod, you can get a loan from Wonga. The Wonga website has a friendly welcoming look and feel. Transparent, relevant, simple, welcoming. These are a powerful set of attributes for any brand to own and virtually unique in the financial market. Think about the last time you took out a mortgage, or a pension, or life insurance, or an annuity – just how transparent, relevant, simple or welcoming was that experience?

The difference between Wonga and the rest is that the conventional financial services business is built on confusion and obfuscation. You need to consult and expert because of the layers of complexity that lay between you as a consumer and your final decision. It’s a bit like going to a train station to buy a ticket to Manchester and being given an in-depth briefing on the engineering attributes of the various engines and carriages you could travel buy.

Traditionally there was profit in the confusion, but over the long term has this led the consumer to have more or less confidence in financial services. Are they more or less likely to buy services where they have a choice?

Wonga has applied good branding practice to a very murky area of finance and has grown powerfully as a result. How long will it be before other financial institutions sit up and take notice?

Written by Lulu Laidlaw-Smith, Commercial Director of Honey